Spend $50 and get FREE SHIPPING

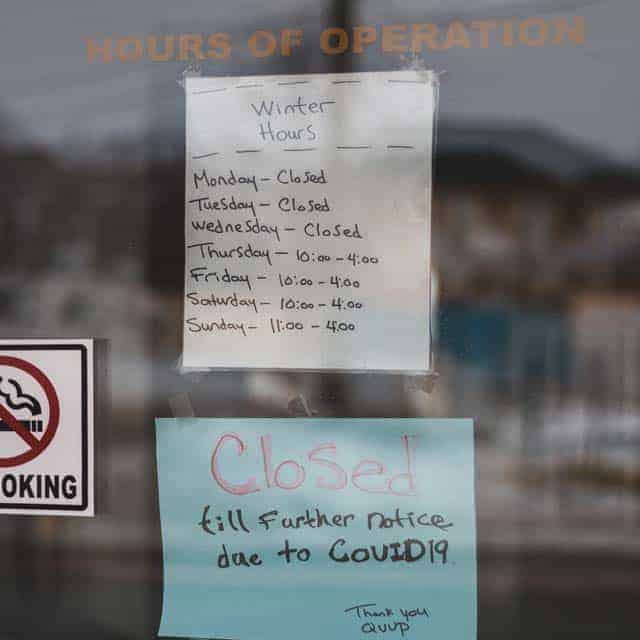

We want to be real with you. As a retail-focused business, 75% of our revenue has come to a standstill due to the Coronavirus pandemic, and we are feeling the impact. As small businesses around the world face difficult times, we would like to offer some resources that can help.

According to the New York Times, the average small company “takes in $381 a day and spends $347,” leaving most of them with enough savings to last for just 27 days without revenue. In an attempt to protect the economy and provide support for America’s businesses, the federal government included a $376B program to provide tax credits to companies that keep workers on their payroll, even as they are working from home, furloughed, or forced to take time off due to sickness.

Additionally, the Small Business Administration has rolled out low-interest disaster loans to provide working capital to American businesses who are taking a hit. Most states have followed suit with various low-interest loan and tax credit programs–you can take a look at a breakdown of what’s being offered in each state through this spreadsheet created by Gusto, a service providing payroll, HR, and benefits to small brands.

While these efforts are incredible, many small businesses are left wondering how tax credits will help them in the short-term, while others worry that loans will hurt them in the long-term. Many other organizations and private businesses are stepping up to fill that gap by offering low-interest loans, fee waivers, free services, and more for small companies that are struggling to survive during the COVID-19 pandemic and resulting economic crisis.

Here is our list of the best public and private relief for small businesses facing financial difficulty during the Coronavirus pandemic.

At the encouragement of the FDIC, multiple banks have sent out messages signaling that they are willing to be flexible in working with small businesses during the economic downturn. Citibank is waiving monthly service fees for the next 30 days, while JP Morgan Chase and Wells Fargo have already donated millions to global relief funds and nonprofits. New York City banks have also been mandated by Governor Cuomo to waive all ATM fees, overdraft fees, and credit card late payment fees. Head over to Forbes for updated information on all of the banks providing financial relief.

Circle Up helps power the growth of early stage consumer brands with flexible loans, data driven insights, and a vast network of resources. They are offering low APR, no fee, flexible loans for small startups ranging from $20K – $3M. They also offer market insights and helpful advice for consumer product goods companies on their blog, The UpRound.

Facebook has created a pool of $100M in cash grants and free ad credits for up to 30,000 businesses experiencing disruptions during the COVID-19 outbreak. Sign up here for updates.

Verizon has teamed up with Local Initiatives Support Corporation nonprofit group to bring $2.5M in loans for small businesses. They will be awarding grants of up to $10K to entrepreneurs of color, women-owned businesses, and other companies in historically under-served places who don’t otherwise have access to flexible, affordable capital. Verizon will also be highlighting the companies who receive grants through this program in their weekly “Pay It Forward Live” online concert series.

For businesses who are already turning to community crowdsourcing campaigns to see them through these difficult times, GoFundMe is making $500 microgrants to match successful fundraisers. Their Small Business Relief Fund was founded in partnership with Yelp and Intuit Quickbooks to provide micro-grants, tools, and resources to small businesses affected by the pandemic.

SCORE is a nonprofit organization that works in partnership with the Small Business Administration to provide education and resources to small businesses and entrepreneurs at all times. During the COVID-19 crisis, their expert mentors are volunteering to help business owners navigate financial needs, identify funding sources, and utilize their existing funds in the most effective manner.

Social media management tool, Hootsuite, is offering affected businesses free access to their Professional Plan from now until July 1st. The plan includes the use of their social media scheduler as well as access to free apps and learning so that small businesses can better reach online customers.

Google is now allowing free access to the “Enterprise” version of Google Hangouts, which allows teams to communicate remotely with up to 250 users per call as well as video recordings and live streaming capabilities. This offer is available through July 1st.

Jamm app is offering four months of free audiovisual communications for teams affected by the global pandemic. Apply to sign up here.

The SEO experts at Moz have opened up all of their training courses for free, so business owners can level up their SEO and direct marketing skills at no cost.